Trending Today

We took a deep dive into the news and asked actual experts so you don’t have to keep wondering.

It’s probably fair to say that most of the people who frequent this website aren’t exactly moths who listlessly float toward the enticing lights cast by…corporate financial news. I would certainly count myself among that number, the brief skim of Reuter’s “Mergers and Acquisitions” I took just now literally made my eyes feel heavy enough to go to bed in the middle of the day. When the news is directly relevant to a product (such as a game or two, or five) that we know and love, however, it’s naturally going pique the interest of its “tuned-in” fan base. Case-in-point: the recent news that Asmodee will be spun off from its owner Embracer Group along with a farewell gift of $958 million dollars…of debt. Of course, the typical fallout from a news story like that is speculation from the fans.

Rampant speculation.

This is completely understandable. I can certainly say that the news raised a lot of questions in my own mind: Embracer was in love with the profits Asmodee was netting them, why then would they cast it off with nearly a billion in debt? So, I decided to do some digging. In my recent article where I made some predictions about Star Wars Tabletop, I mentioned that I’m an “interested observer” of the business side of miniatures and card games, but clearly that does not make me an expert. I’m someone who places a lot of value in expert opinion, I think it’s one of the cornerstones of a functional society and I live in fear of the continued threat social media poses to it. So, what am I gonna do about it? I’ve already avoided contributing anything productive to this site for a whole month, my last post was a “stealth” review of Gremlins 2 for God’s sake. So yeah, I asked some experts, and I’m going to do my best to shed some light on the only thing that we actually care about: what it will mean for the games we love.

If you really just want a “Too Long;Didn’t Read” though, feel free to scroll all the way to the bottom. But can you really trust a conclusion without evidence? Am I really just trying to guilt you into reading the whole thing because of all the time I spent on this? There’s only one way to find out!

To start things off…let’s do the numbers (please click, important for ambiance, especially if you’re a millennial who was exposed to massive amounts of NPR Marketplace as a child).

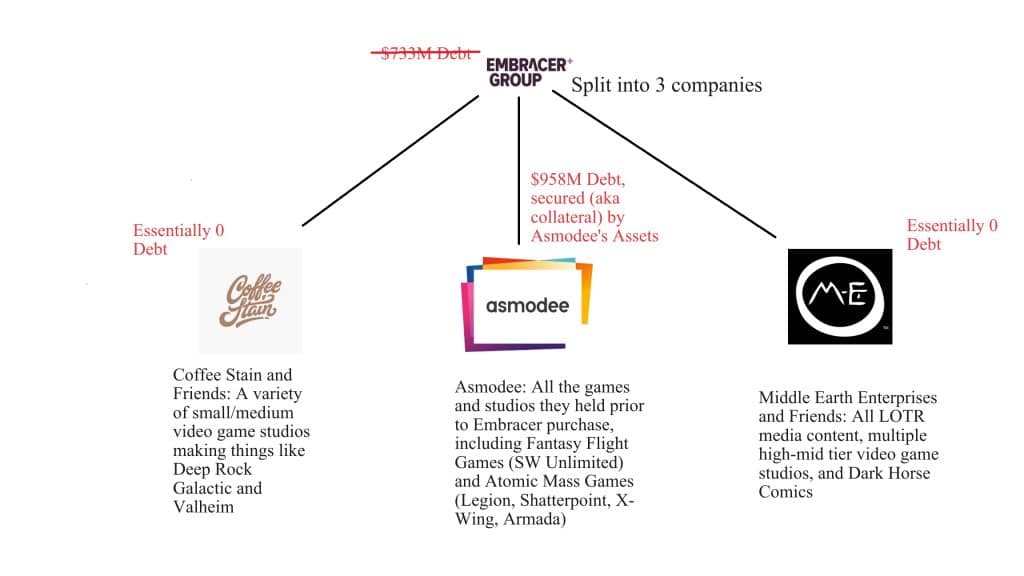

I made the graphic above to demonstrate the summary of “what happened” a couple weeks ago. If you’re curious about the official announcement, click here, but this is the short version:

Embracer had a very bad last couple years, lowlighted by a roughly $2B deal with a Saudi Arabian company that dissolved in the 11th hour, resulting in their investors fleeing for the hills, which in turn resulted in some headline-making closures of some of its holdings including several video game studios. In the video game world, it was basically an Armageddon, where over 1400 employees were laid off, 7 studios were shuttered, and 29 games were completely cancelled. Asmodee itself, however, was mostly spared. Why? According to Embracer’s 2023 earnings report, Asmodee ran an Earnings Before Interest and Taxes (EBIT) margin of 6%. In layman’s terms this can be thought of as a profit margin and 6% is square in the middle of viability. Compare that to its EBIT margins in video games (0%), mobile games (-4%), and comics (-3%) and you may already be seeing the reason behind the moves that were made.

This may be a forced metaphor but I’ll go for it. Embracer was like a three-person canoe that was beginning to sink, but only one of the three people was doing any work to bail out the water. The layoffs and closures somewhat patched the hole that caused it to sink in the first place, but those other two people were still weighing the boat down so the two layabouts were told to get off and get to shore so that the last person (Asmodee) could get that water out and save the boat, which will now be easier without that dead weight. Is that fair? Not really (though I’ll get to why it’s not heinously unfair below), but it’s business.

“Sure you two, you’re doing great, I’m sure everyone is really excited for that Goat Simulator DLC…I’ll just keep making things that actually turn a profit.” – Asmodee, probably

How much “water” are we talking about?

Now that we’ve set the stage, let’s get to the part you clicked for: the part where I provide the opinions of people who actually know what they’re talking about.

My primary expert resource for this article was Milton Griepp. Griepp got his start in the comics industry and founded Capital City Distribution in 1980 which lasted as a major player in distribution until it was acquired in 1996. Since then, Griepp has published Internal Correspondence which was a trade magazine initially and is now a website (IcV2) which is essentially considered to be the gold standard of business news for “geek culture” (primarily comics and hobby games) as evidenced by its utilization by publications like the New York Times, Wall Street Journal, and Fortune. Mr. Griepp was kind enough to correspond to me over e-mail so I could understand more about this business move.

I began by asking Griepp if anything felt unexpected about the act of saddling Asmodee alone with what was essentially the entirety of Embracer’s debt. His response was somewhat surprising to me but it makes sense in retrospect. “I interpret this as assigning debt used to acquire Asmodee to Asmodee in the spin-off.” he wrote, “Asmodee’s were the assets being acquired, so it makes sense that the debt is associated with those assets.”

This is of course a reference to the fact that it was not long ago, just 2 years, that Embracer bought Asmodee in the first place from PAI partners (for roughly $2B). Therefore, a significant aspect of Embracer’s total debt was a leftover from that deal which was made to acquire those assets from jump. Thus, one can interpret this as somewhat of a cost Asmodee will have to pay for its own independence on the public market. Naturally, Embracer’s woes with its other holdings are a huge asterisk to that, but it does make it all seem a LITTLE bit less “unjust” when it comes to who will shoulder the load.

I then turned to the games themselves. “According to the polls on IcV2, Marvel: Crisis Protocol, Shatterpoint, and Legion are very successful miniature games.” I began, “What kind of effect would you predict this restructuring would have on these games for the next couple years? On the other end, do you think it’s likely these changes could affect games with fewer new products of late such as X-Wing?” His response was simple: “No, I expect minimal changes to operations as a result of the spin-off.” If you’re mainly interested in this part of the analysis, you can skip down to the “Tying it all together” section closer to the bottom, we’re going to take a bit of time to dissect how “in trouble” Asmodee really is.

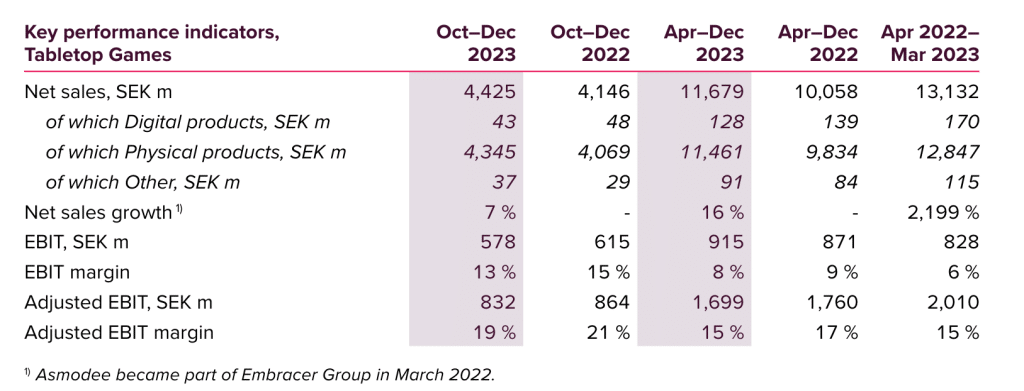

Asmodee’s latest earnings trend from Embracer’s Sept-Dec 2023 quarterly report, which is roughly stable year-over-year, reflecting reliable profitability. Shatterpoint and (the anticipated sales of) Unlimited were the Star Wars games mentioned as highlight elements in this report. By the way, this is in Swedish kroner (SEK) which is about the value of 1/11 of one USD.

I asked Griepp for his opinion on Asmodee’s financial fate. As it stands now, there is a net debt to EBITDA ratio of 3.9x (in other words, their debt is worth 3.9 years of profits counting expected depreciation of their current assets), which is basically right in the middle of “fine” and “bad.” This has been an understandable source of consternation among gamers, especially those who are familiar with the fates of KB Toys and Toys R’ Us, who ended up getting crushed under the weight of debt in very public and very ugly ways. The bigger problem than the ratio is the term: there’s no scenario in which Asmodee is going to pay it off on time, but they have about 10 months to convince the lenders to refinance it before we get too close to the 18 month maturity. “Although the debt has a short term, I assume that’s because the Embracer debt it’s replacing is also short term,” Griepp explained, “ten months gives Asmodee plenty of time to refinance it over longer term, allowing it to pay it off over time from profits.”

Special thanks to Mr. Griepp for his contribution, be sure to check out IcV2.com if news about the industry itself is of interest to you. By the way, when I asked him if he had a favorite Star Wars tabletop game, he gave me a classic: “Star Wars: Trivial Pursuit.”

To dig into the financials a little more I spoke to two other individuals with occupational expertise in corporate investment on background. “They do these deals when they have no choice and they have to put the debt somewhere.” one said “But debt doesn’t disappear, it’s just reallocated. Often it’s not reallocated well.” The other put it more bluntly. “When splitting off normally one of the assets is gold and the other two are s***.” He cited as an example when a major American shopping mall group (Simon Property Group) spun many of its malls off from itself into a new company (Washington Prime Group). That was a decade ago, since then Simon Property has flourished while Washington Prime filed for bankruptcy three years ago. The primary reason for this is that one got the financially viable malls and the other got…the rest of them. My contacts acknowledged, however, that the way it’s supposed to work is the way it seems to be going with Asmodee. “They usually put the debt on the companies with the most profitability because they can ‘afford’ the debt,” one explained, “[but] that sometimes chokes the company and kills it instead.”

They concurred that the 3.9x net debt to EBITDA ratio is concerning but not in alarm bells territory, if the company continues to be profitable then they should be able to refinance in order to escape the 18 month maturity of their current loan. “If it climbs to 5x or above then it’d be hard to refinance.” This is where I’ll note why this spin-off is quite a different animal when compared with two other companies in the toys/games industry that I’ve seen cited on social media as portends of Asmodee’s fate.

It’s true that both of these companies were victims of the dalliances of irresponsible ownership, but there are a number of key differences to note. First, KB Toys’ downfall was driven largely by Bain Capital’s (a private equity firm, not publicly traded) dividend recapitalization (which basically loads a company with debt to pay off individual investors who want cash right away). This was a move many creditors labelled as extremely irresponsible on Bain’s part. Dividend recapitalization in and of itself was blamed for a lot of bankruptcies in the mid 2000’s, and has since been considered very controversial and risky. It still happens but is less common now and is not a factor in the Asmodee spin-off. Later, Bain Capital made waves along with Vornado (a real estate company) when it took Toys R’ Us private and saddled them with $5B in debt that they were never able to pay off. They filed for bankruptcy a little over a decade later. News stories like this drove government action, a small section of the 2017 Tax Cuts and Jobs Act actually made behavior like this less attractive because corporations can no longer get tax breaks from losses suffered in such moves.

In summary, KB Toys was the victim of severe private equity chicanery that forced a middling company to crash into the ground while Toys R’ Us was the victim of slightly less heinous private equity chicanery but with a starting point of a company that was already losing money. Now let’s compare to Asmodee’s spin-off from Embracer. Embracer itself is (was now, I suppose) a public company that is therefore much less able to engage in predatory practices, and all three of the spun off companies will remain public as well. Furthermore, though it did acquire a lot of debt with a very short turn around time, Asmodee is the one branch of those three that has demonstrated clean profits.

Pictured: Bane messing around with capital, ironically he wouldn’t have gotten along with Bain Capital at all

A key factor in considering this entire situation is a simple one: everyone wants to come out of the other side richer. JP Morgan and all the rest who now own Asmodee’s debt wouldn’t have made the loan if they weren’t planning to profit from it. Though it’s not quite something you’d typically say in a press release, the plan from get-go was very likely to get the job done spinning off the companies and then see how well Asmodee does on their own, fully planning to refinance the loan to give them actual opportunity to pay it off.

I’ve seen some fans theorize that the debt-holders are salivating over their chance to sell everything down to the dust under the welcome rug of Atomic Mass Games, but carving up and liquidating assets is pretty much always going to net you less profit than just getting the loan paid off with cash. In other words, if JP Morgan and their Swedish bank pals think there’s a chance that Asmodee can pay them off eventually then they’ll be glad to wait longer to get more total cash back when interest is accounted for. And when we consider that the earnings reports we’ve seen so far don’t account for Star Wars: Unlimited at all (which is now basically completely sold out at retailers), I see no reason in particular to worry that Asmodee’s earnings won’t be enough to convince the banks to start panicking.

Even if us optimists are all wrong, and Asmodee does eventually kick the bucket, does that mean valuable assets such as games with a large fanbase are simply going to go away? Of course not. Again, if you make the assumption that there’s always going to be a willing corporate buyer for a valuable product, then you can breathe a sigh of relief that your game will be ok. Don’t believe me? Just take a look at HeroClix, another IP-licensed miniatures game. I played this game myself back in the day, and I remember the fan-panic that happened when its owner at the time (Topps) decided that games are too hard and that it was gonna stick to trading cards. This wasn’t some complex spin-off, they literally just stopped making it. But HeroClix was a popular game, and so “shockingly” that game, along with its Marvel AND DC licenses, were bought from Topps by another party (NECA) and the game was quickly alive and well again in less than a year. That was 15 years ago, and despite having made 319 or whatever versions of a character simply named “Green Lantern,” that game is still alive and kicking. There is lots of money to be made from the current crop of Star Wars hobby games, so even in the worst case scenario I can basically promise you they’d find a new home.

But will this pressure to maintain solvency mean that Asmodee will begin breathing down the necks of all its studios to be as profitable as possible? As above, Mr. Griepp didn’t seem to think so. For what it’s worth, that would be my assumption as well, and I’ll even tell you why. Apologies for repeating myself, but at the corporate level the goal is to turn a profit regardless of who the boss is. For a game studio’s internal decision-making and politics, this basically means it will be status quo, they’re still making a product at the end of the day. For Star Wars: Unlimited fans, that means Fantasy Flight Games will be focusing on how many booster packs they really need to make to sell through to stores just in time for the next expansions to release (instead of too quickly like this first set)…which is the same thing they would have worried about anyway. For Legion and Shatterpoint fans, Atomic Mass Games will be focused on keeping the game healthy with expansions that players will be into as well as keeping up the word-of-mouth wins they got with a very healthy showing of players at Adepticon this year...again, the same as it would would have been with or without a spin-off.

Pictured: The greatest mini ever made, I own one and am damn proud of it

Of course I can’t forget X-Wing and Armada. Again, the situation is the same here as it would have been if this news never happened: there’s not really any signs there will be new products. IcV2 recently published an interview with Will Shick, and his focus was naturally on the games that actually got announcements at Adepticon this year: Legion, Shatterpoint, and Marvel: Crisis Protocol. There are plenty of potential reasons for this, my suspicion is that despite its popularity the profit margin on X-Wing and Armada is significantly lower because the minis are fewer (thus consumers expect to pay less for them) but at the same time more expensive to make (since they are painted and assembled).

We may never really know, but no amount of trolling AMG during their public engagements that have to do with other games is going to change their mind (seriously, please stop doing that, it’s literally pointless and rude to the poor social media folks who have no control over these things). I obviously don’t know the future of these games, but once again (this is the last time I swear), questions about the future of these games was just about everywhere before the Asmodee spin-off anyway. For now I hope people that love those games do continue to play them (I really love Armada myself, I just rarely find the opportunity), and I hope they continue to get supported with organized play, rules changes, and print/play releases at the very least. That hope is bolstered by the recent announcement that Worlds in 2025 and the Grand Tournament system will support all these games.

I hope this was helpful and not overly dry, my hope is that this can lead to us focusing our anxieties on things that actually matter, such as exactly how many suppression tokens I’m going to get from Empire lists now that Range Troopers are coming out. Love it or hate it, corrections or kudos, please leave a comment here or on the Star Wars: Legion Facebook page. Thanks again to Milton Griepp and my other contributers, sources for other info are directly hyperlinked where relevant.

Get out there and enjoy these great games.

Just watch out for those private equity firms!

Copyright © 2024 The Fifth Trooper. All Rights Reserved.